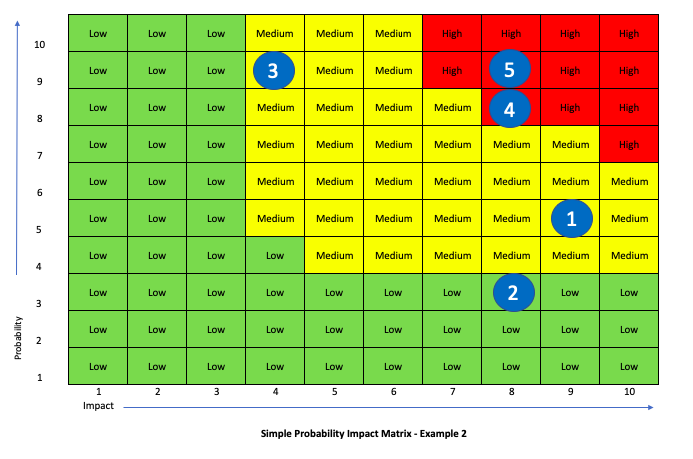

Risk AvoidanceĪnother risk response is to cover every possibility of the risk becoming a threat.Ĭompanies often choose this option when the risk has consequences for employees’ safety, is in violation of the law, or when it forms a threat for the organisation as a whole. Production companies that depend on certain raw materials could also ‘protect’ themselves to prevent higher costs for raw materials. By transferring the risk, the risk is not reduced but rather transferred to a third party.Ī common risk transference method is to take out insurance. Risk TransferenceĪnother possible response to a risk is transferring the risk. This does not reduce the chance of getting into an accident, but it does reduce the negative impact of a crash. For example, we wear seatbelts in the car. Risk reduction is used in practically every situation in daily life. Reducing the risk means taking action to reduce the probability or impact of a risk. Reducing or mitigating the risk is a different risk response that can be deployed. Risks that will not occur until later are also often placed in this category. In many organisations, budget is reserved to act in such situations. This strategy is often used for risks with a low impact or a low probability. The first option is to respond to a risk by accepting the risk as it exists and refraining from any action. Risks can be approached in one of four ways. In case of a risk that could halt the entire production line of a company, for instance, adequate response is required to limit the damage. Sometimes, running a risk is not as bad as it sounds and it’s simply accepted. Risk Impact Probability Chart and risk mitigationĭifferent reactions are possible to the displayed risks in the risk impact / probability chart. In many situations, the risks in this category are indicated in green and immediate action is not called for. The bottom left displays the Risk Impact Probability charts that have a low impact and that are unlikely to happen due to the small chance. The probability that the risk occurs is high, but the impact the risk will have is most likely small. These risks are often given the colour orange in the matrix. The risks with a low impact but high probability are medium risks. The various responses to risks are explained in the next chapter. Different responses befit the various types of risks. High Impact / Low ProbabilityĪ risk with a potentially high impact but a small chance of the risk coming true, is denoted with the colour orange.

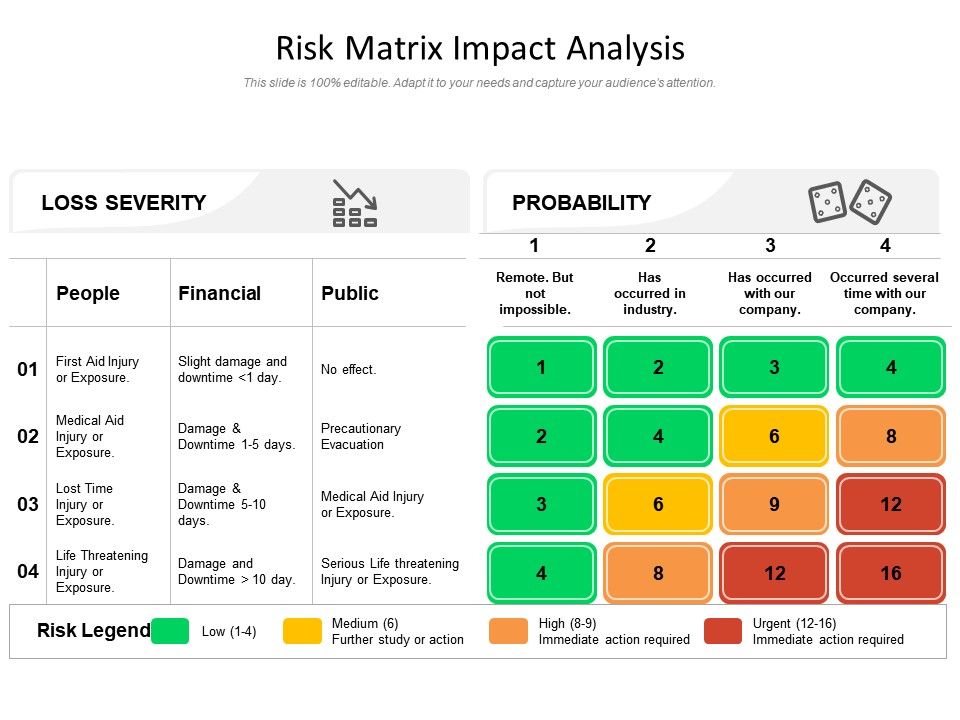

In the Risk Impact Probability chart, or risk matrix, this group of risks is usually denoted with a red colour. The top right contains the risks that have a high impact, and that will most likely happen. These are subsequently assigned a colour and are added to the risk matrix. The risk categories below can be deduced from the graph. The graph above represents these two criteria on the x and y axis. The Risk Impact Probability chart shows whether a risk has a high chance of occurring and what the impact of the risk is when does occur. What shows a Risk Impact Probability Chart? The impact assessment is also assigned a score of 3, 2 or 1. The central question is: if the risk were to occur, would this be catastrophic for the project or activity? Or would it be a minor inconvenience? An effect assessment is usually carried out by the risk manager, and by the people who have the right knowledge to estimate the risks and establish the impact. Impact assessment means assessing a risk’s impact if the risk were to become reality. 3 represents a high risk, 2 an average risk, and 1 a low risk. Is there a certain frequency with which the problem occurs? When determining the probability of a risk, a score is usually assigned to the risk, such as 3, 2, 1.

This probability is generally based on historical information. Risk probability refers to determining the probability of a risk occurring. Do you want unlimited ad-free access and templates? Find out more

0 kommentar(er)

0 kommentar(er)